As this author celebrates 30 years in private practice this month, I can think of no issue about which I have seen more confusion, misunderstandings, and lack of context over that span than the issue of our National Debt. Every four years, as Americans go to the polls, the party out of power in the White House finds a way to misrepresent and assign responsibility for the national debt to the party currently in power in the White House. The implication is that presidents, rather than Congress—which has the constitutional power of appropriation—do the spending in this country. Worse, the implication is that bond holders, those actually buying our debt, have nothing to do with it. These false assumptions even get repeated by anchors on the financial networks who should know better, an unfortunate trend in media today.

When a purchaser buys stock, they become an owner of a company. When a purchaser buys bonds, they become a loaner to a company, country, or municipality. Both stocks and bonds are purchased on autopilot via payroll deduction every weekly payday in the United States, based on the fund elections that employees chose for contributions going into their 401(k) plans at work. If one of your 401(k) plan holdings is a “Growth and Income” fund, the term “income” implies the ongoing purchase of bonds. When the manager of a pension fund for teachers or nurses in Paris, Budapest, or Chicago is required to maintain, for example, a 35% allocation to “AAA-rated sovereign debt”, this means that every pension contribution on the part of the employer, union, or employee purchases U.S. 10-year Treasuries, and other comparably creditworthy debt from around the world. Our Treasury is constantly issuing debt, because credit is the indispensable lubricant of every solvent economy.

Corporations, state and local governments, and individual borrowers all need credit in order to borrow to bridge accounts receivable, payrolls, mortgages, and credit card purchases. While we can agree that over-indebtedness is a bad thing, debt in and of itself is just as foundational a building block to any economy as are stocks. Debt is no more “bad” than bonds are bad, than stocks are bad. They are tools in our collective financial toolbox, and they are utilized by millions of people around the world every day.

How Much Do We Owe China?

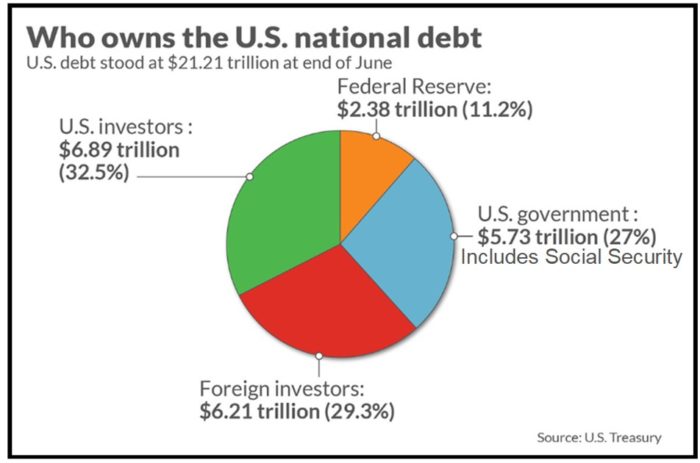

As the chart to the right shows, Americans owe most of our debt to ourselves. Social Security, government, military, and corporate pension plans, and retired Americans own the majority of our debt. Among foreign countries, China holds $1.138 trillion in U.S. securities and Japan owns $1.018 trillion. Like every other bond holder, these nations are investors in America’s current and future solvency, based on our having the strongest consumer-led economy in world history. Given that the dollar is also the world’s reserve currency—and no other nation or basket of currencies has anywhere near the international confidence that the dollar enjoys—China would be foolish to sell those bonds in an attempt to manipulate or erode that confidence. Since their share is only 4.5% of our total debt, anything China did to its entire share would have minimal impact, and only undermine the world’s confidence in its own fiscal stability.

An Analogy

When politicians and some economists make alarmist statements about the level of our indebtedness, they need to also include our National Income in that conversation. Debt has no context without comparing it to the amount of income earned each year by a corporation, an individual, or a nation. Prior to the fear of coronavirus shutting down the “nonessential” parts of our economy, most analysts were in agreement that our Gross Domestic Product (GDP) as a nation was about $21.4 trillion. Anchors on the financial networks often begin a sentence with, “…In a $22 trillion economy…” According to the national debt clock, our debt is now over $25 trillion, a seemingly gargantuan number. The number by itself, however, is meaningless without considering what the interest rate is on that debt, how large a slice of our annual budget that represents and, most importantly, what our annual income is as a nation in the context of debt.

An easy analogy is to simply trim eight zeros from both numbers. Imagine a family of four, where the couple has joint income of $214,000 a year, and they owe $250,000 on their mortgage on, say, a $450,000 home. As long as their employment remains stable, this couple most likely enjoys a credit score of over 790, something many Americans would envy. The twenty years that they might have left on their 30-year mortgage is easily affordable, and they have plenty of surplus income. What banks and mortgage lenders focus on is not the amount of the mortgage, but the amount of the mortgage in light of the couple’s demonstrably stable annual earning capacity over the last three years. In the same way, we need to look at our national debt in the context of a) the interest we’re paying each year to maintain it (now at record lows), b) the term of the debt (typically 10 to 30 years), and c) our annual income as a nation, before we declare that debt “unsustainable” missing such context.

This brings me to my final point. Amid the coronavirus shutdown that our leaders have self-inflicted on our economy, our GDP, which was averaging just below 3% per year in the last four years, is now estimated to be down -34.9% in Q2 and dropping. The sooner we get that remedied by reopening the economy, the sooner we can accurately estimate the impact and cost of the relief packages that have recently added nearly $2.4 trillion to the deficit in just the last six weeks. That, my friends, will be with us for decades to come, long after the virus passes into history, and is the true cost of this unprecedented folly.

6 Comments

Thom,

Do the figures you cite include the value of properties owned in the US by China? What about the abandonment of large properties owned by China in the US? What does China gain by abandoning those many, many properties?

Georgianne

Good morning Georgianne,

Thanks for your comment. The figure I shared was merely China’s share of our debt, i.e. the U.S. Treasuries they’ve invested in, and do not include the U.S. real estate holdings of Chinese-owned corporations. I’ve read nothing anywhere about those firms abandoning those properties, and would be skeptical of any reports alleging that. The Chinese have every reason to continue to imbed themselves throughout our industries in ways that American corporations would be prohibited from doing in China. If you’d like to read more on China/U.S. relations and the tensions and challenges we face in dealing with China, I recommend Mike Pillsbury and Gordon Chang’s experience, research, and books on the subject.

Best,

Thom

An excellent and simple explanation on debt vs. income, something that most people miss or don’t know.

The other important point that you’ve made, is reminding people who’s really responsible for our national debt, which is of course Congress, not the President.

A case and point. The (Republican) President has asked for an additional $250 Billion to supplement payroll, but by the time Congress finished adding all their favorite ‘Pork’, such as millions for the ‘Kennedy Center For the Arts’ in New York among many others, that amount ballooned to $384 Billion.

$134 Billions of wasted money only to get the Democratic Congress to approve the money necessary to supplement payroll.

If you need another example, this week the Democratic Congress will deliver their newest wish list, Billions of dollars to failed Democratic States/Cities under the false pretend of helping them with virus-related expenses, which in fact, is to bail them out of the heavy burden of their “generous” pensions they have been giving to Union members in order to secure their votes come election day.

Thank you for those insightful comments, Zafi! What is truly shameful, is the now-documented scandal in the medical examiner’s offices of those failed blue states, wherein MEs are being encouraged to classify every death as coronavirus-caused. As doctors around the country are saying/posting by the hundreds, comorbidities are usually the actual cause of death, and people are dying with coronavirus, not from it. (It’ll be curious to see how many heart attacks NYC averaged per month in February through May in recent years, and how many deaths by heart disease occurred this year.) This is all about the money. When the Federal fire hose is blasting trillions at a problem, the scramble for a few hundred million here and there gets lost in the background noise. Our Federal budget deficit for 2020 was just under $1 trillion prior to our overreaction to the virus, and is now over $3.7 trillion. The insanity has got to stop.

My prediction is that as red states open up and prove to the country what essential businesses have been proof of for months, all those affected and struggling formally “nonessential” businesses throughout the country, in blue states as well as red, will create a groundswell of anger lasting throughout the summer and fall. Unless the virus comes back for a second round in November, that anger will impact elections at every level of government nationwide, from elected judgeships in Texas, to governors and even state reps. There is no pandemic exception to the Bill of Rights, as protesters are making clear everywhere. Let freedom ring!

Best,

Thom

Thom,

Apropos of your last comment about the virus, I read an article about why US is prepared for second wave. I pulled these paragraphs.

“We’re in the fight of our lives but we will win. Americans don’t lie down, give up and quit. We will continue to improve as we learn more and we each do our individual parts to keep one another as healthy and free of this virus as possible.

While any of us could live in fear and panic, that is a choice. Make your choice to live responsibly while remaining calm and confident and making smart decisions. That is the only way to live and to beat COVID-19 once and for all.”

Thanks for the excellent financial discussion.

Susan

Thanks for sharing, Susan. From your keyboard to Fauci’s ears! Georgia now has a 3-week reopening head start over the other states, and their deaths and cases are still going down–contrary to the panicked voices of many reporters at the time. And, happily, sheriffs and state supreme courts are siding with small business owners who are opening responsibly, ahead of their Governor’s directives. Government needs to trust the citizenry to make responsible choices in their best interest, where they have every incentive to protect their customers with a clean, safe gym, salon, or storefront. Let commerce begin, let free association resume, and let freedom ring!

Best,

Thom